With over 15 years of experience, we've become a trusted source for exchange rates for personal, corporate, and organizational data on currencies.Į is the perfect solution to balance the complicated world of currency exchanges and intuitive and straightforward design. We've teamed up with leading data providers always to present you with up-to-date and precise exchange rates.

Once you complete the search, you'll be able to view current and historical currency rates.

#Currency rates exchange iso

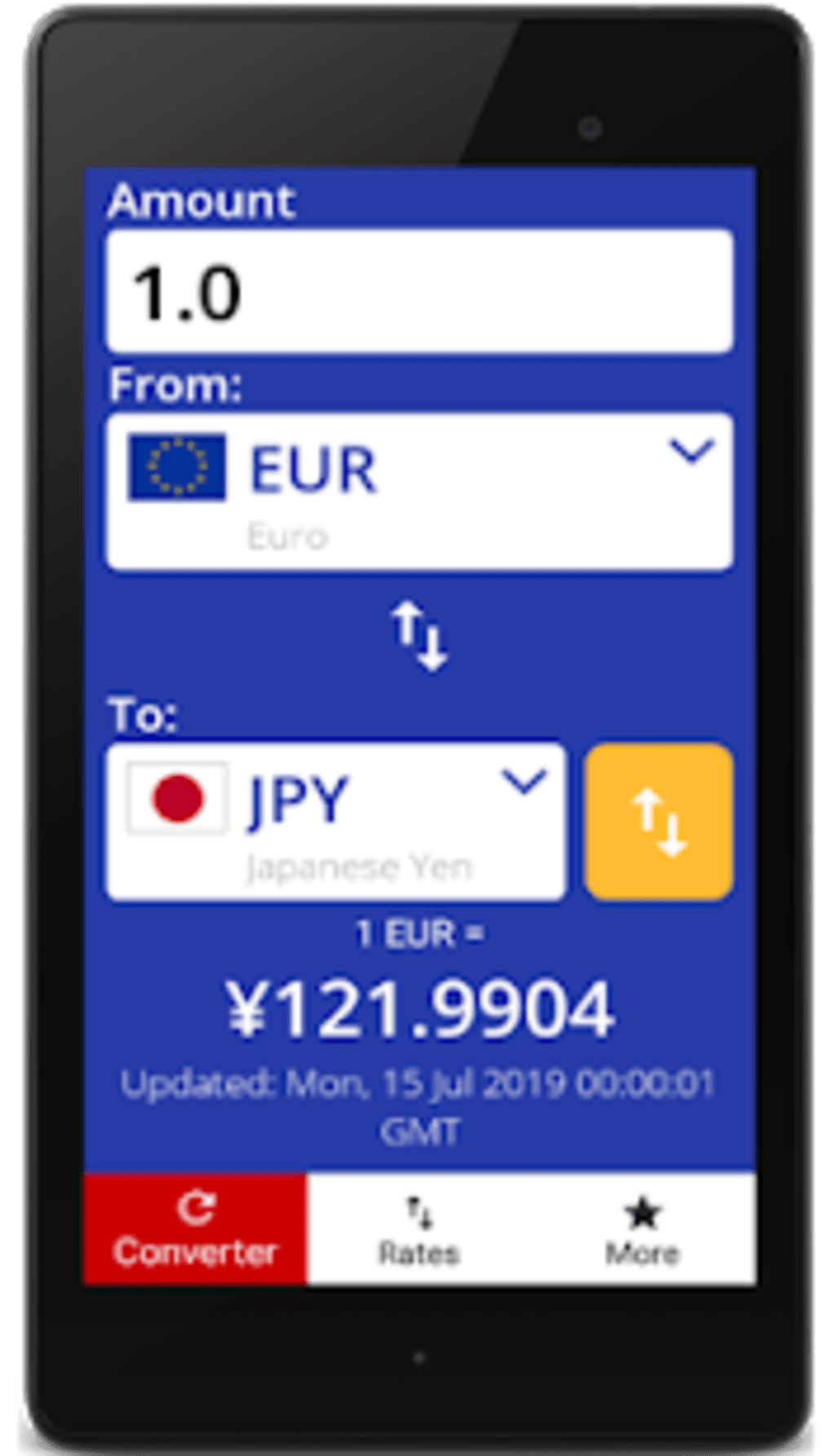

Choose a base and foreign currency from the dropdown, using a 3-letter ISO currency symbol, country name, or currency name. We strive to keep our website accessible and intuitive. makes checking currency rates easy and intuitive. The data we provide is up-to-date and supplied by the market-leading provider - Xignite.

allows you to check the latest foreign exchange rates.

#Currency rates exchange full

For full details regarding any fees which may apply please refer to the Personal Service Charges/Statement of Disclosure available at any HSBC Bank Canada branch or online at. A monthly fee will be charged if you do not meet at least one of the conditions above. Also, track exchange rate changes over the last days, and query currency rate. Ĥ HSBC Advance requires you to have an active HSBC Advance chequing account, and maintain combined personal deposits and investments with HSBC Bank Canada and its subsidiaries of $5,000 or hold personal HSBC Bank Canada residential mortgage with original amount of $150,000 or greater. Exchange Rates and currency conversion calculators for any foreign currency. 1 Foreign exchange traders decide the exchange rate for most currencies. For example, in January of 2022, one euro was equal to 1.13 U.S. Think of it as the price being charged to purchase that currency. For full details regarding eligibility and any fees which may apply please refer to the Personal Service Charges/Statement of Disclosure available at any HSBC Bank Canada branch or online at. An exchange rate tells you how much your currency is worth in a foreign currency. A monthly fee will be charged if you do not meet at least one of the eligibility criteria above. A full list of available countries/regions and a demo can be viewed online.ģ HSBC Premier requires you to have an active HSBC Premier chequing account, and maintain combined personal deposits and investments with HSBC Bank Canada and its subsidiaries of $100,000 or hold a personal HSBC Bank Canada residential mortgage with original amount of $500,000 or greater. HSBC Group may, however, be able to provide similar services through its members in that jurisdiction. Certain services offered by members of HSBC in Canada may be restricted or unavailable if you move to another jurisdiction or are in another jurisdiction due to the local laws of that jurisdiction. The price provided may include profit, fees, costs, charges or other mark ups as determined by us in our sole discretion. We provide all-in pricing for exchange rates. You may also be charged fees by agencies or banks that process or receive your transfer, which we are unable to waive.Ģ Global View and Global Transfers are not available in all countries and regions where HSBC Premier and HSBC Advance are offered. The exchange rate you are offered may be different from, and likely inferior to, the rate paid by us to acquire the underlying currency. The CAD equivalent is determined based on the exchange rates at the time the transfer is processed. View Scotiabanks buy and sell foreign exchanges prices/rates for popular currency pairs and Foreign exchange rates apply to non-cash transactions up to. USD ATM cash available in multiples of $20 and $50.ġ We’ll waive our fee when the wire transfer is (1) in a currency that’s different from the currency of the sending account (2) valued under $10,000 (CAD equivalent) and (3) sent from an HSBC Bank Canada personal account. Check with your local Community Bank for currency buy-back rates and limits.

The rate shown is the rate available only in the country of issuance. Actual exchange rates in country may vary from this rate due to time variances affecting updates. Minimum $100 CAD equivalent order applies to in-Branch conversions. 2 Actual exchange transactions may be different at the banking center than those shown here. Most orders not fulfilled on demand will typically be available via delivery to the branch in 1-3 business days but may require up to 5 days. If debited from a non-CAD account, an initial transaction to convert from the account currency to CAD may be performed prior to fulfilment of order.

Non-CAD currency FX orders debited from eligible CAD accounts. † Available in the branch or via order to your local branch for pickup.

0 kommentar(er)

0 kommentar(er)